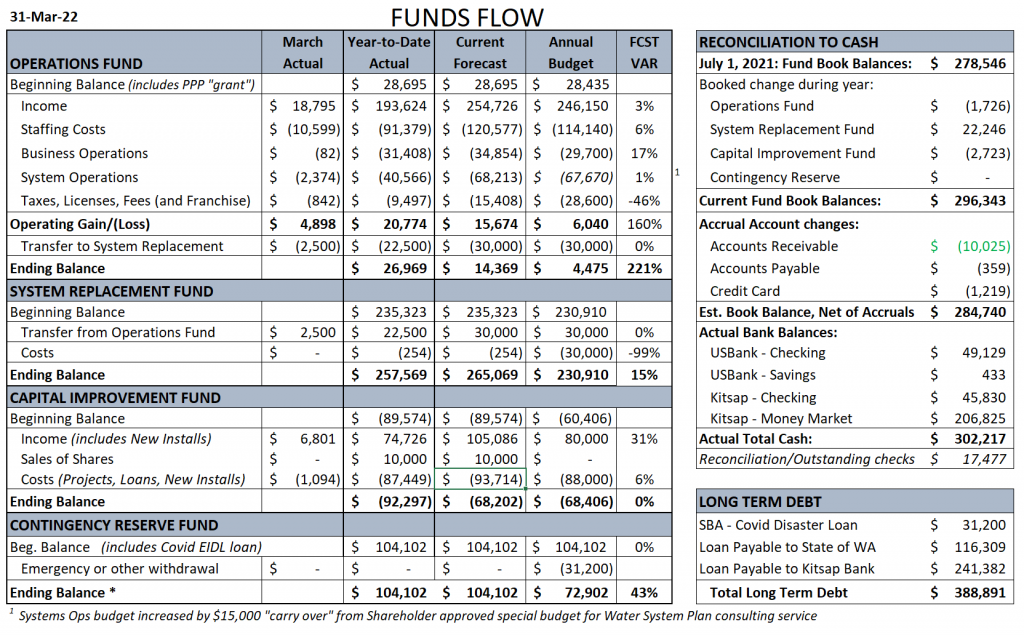

During the annual budgeting cycle we forecast for how we are likely to finish the year, financially — if there are no surprises. Starting this month I will include this Forecast in the monthly summary. The Current Forecast is based on YTD actuals through March plus estimates for April, May and June. The final column is the variance of the Current Forecast vs. the Annual Budget.

The Forecast is indicating that income will be a bit higher than budget. Our costs are higher than budget, too. The Staffing cost variance is mostly explained by the notice period/severance pay we provided. Business Ops overrun is primarily the legal fees that continued longer than we anticipated. The low Taxes is, once again, the Franchise Fee that we budget for but is still undetermined and not yet due.

In Capital Improvements we have more Income than planned because of new connections (we bill for the installation cost) plus the new share we sold. We’ll spend slightly more than budgeted (due to the new service installations) and have the Ending Balance we anticipated. This fund is still $68k “in the hole” since completing the Filtration Plant. Other than raising the Capital Fee, the only way to rebuild this fund is selling more shares (yes!) and making extraordinary transfers from our Operations budget.

Detail Reports from Quickbooks:

Contact me with any questions/comments: Todd, 206-696-1216, twcurrie@yahoo.com