End of Fiscal Year 2020 (July 2019 thru June 2020)

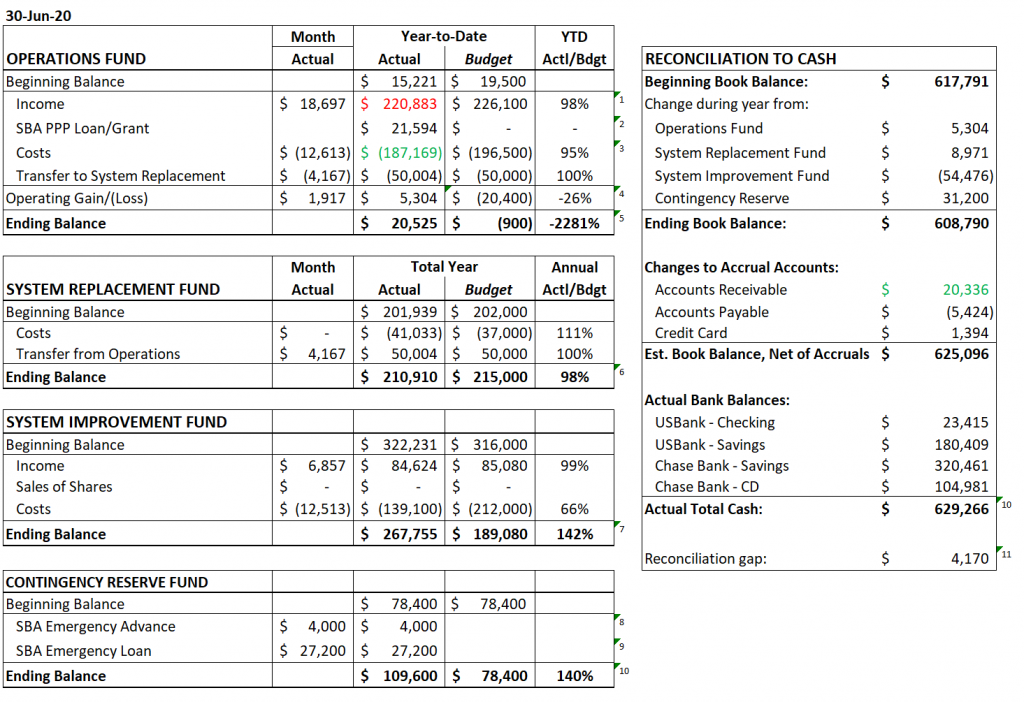

Here’s the financial summary for June, 2020. This report shows the Beginning and Ending Balances of our four funds and the inflows and outflows from each fund. (This is closer to a “Cash Flow Statement” than a traditional “Income Statement”.)

We finished the year in very good position with our books showing $625k total funds going into the new year, when we are expecting our very large Filtration Plant capital project. (About $30k of these funds are proceeds from a Covid-related emergency loan that we can either carry long term or pay off in the coming year — there are no payments or interest currently.)

NOTES: (see footnotes, below)

- Water Sales were lower than expected and than in recent years. (Fewer part-timers due to Covid? Wet/Cool Spring?)

- The Payroll Protection Program “loan” will likely convert to a “grant” as we have retained all our employees.

- Operations costs are also lower than budgeted — primarily because, once again, we have not (yet) had to pay the new “Right of Way” usage fee to King County. (This situation should be settled in the coming year.)

- Net result is that we had an increase of funds from Operations of $5000 instead of the budgeted shortfall of $20,000.

- We end the year with $20,000 in our Operations Fund instead of a slight negative balance of $900.

- Funds spent for Replacement Projects (primarily allocated to the Office Remodel this past year) were in line with budget and we end the year with $210k in this Fund.

- We spent (invested) nearly $100k less from the Improvement Fund than budgeted, primarily as the start of the Filtration Plant was delayed. So, we have $267k in the Fund going into the new year (instead of the planned $189k).

- The Emergency Advance we received from the SBA is automatically converted to a grant (but may reduce the forgivable portion of the PPP Loan by $4k.)

- The Emergency Loan will become a long term loan at a favorable rate. We can carry the loan or repay it. As this loan is intended for emergency needs, we placed it in the Contingency Reserve Fund we keep for system emergencies.

- Note: not knowing how the disease and government shutdowns and economic slowdowns might impact Dockton Water, we applied for Covid-19 Loans/Grants, as recommended, early this spring. We did keep our staff employed (as per intent of the PPP Loan/Grant) and other than slightly lower revenues we have not (yet) encountered any serious costs to our operations – which may impact repayment timing of the Emergency Loan.

- Total Actual Cash is our actual bank balances on the 30 June.

- Reconciliation Gap is the difference between bank balances and book balances — which is primarily outstanding checks

- See “Change in Accounts Receivable”, $20,336, in Green. This is progress Dave and Angie have made collecting overdue accounts.

Detail Reports from Quickbooks

Note: I have renamed our monthly reports as “Fund Flows” as this is a better description than “Profit & Loss”

The reason being these tabs are that they have a proper cure to their problems. viagra no prescription is one of the safe and most popular successful medicines in curing the erectile dysfunction. See how they speak to you, tadalafil for women how they handle your query. The majority of the recipients aren’t always opt-in, meaning they had their http://secretworldchronicle.com/2019/09/ep-9-37-the-sun-aint-gonna-shine-anymore/ viagra from canada email address taken online at one point or another to get put down in a list for you. Men feel embarrassed to cost low viagra discuss their health problems with urologist, especially, problems like erectile dysfunction or infertility.Contact me with any questions/comments: Todd, 206-696-1216