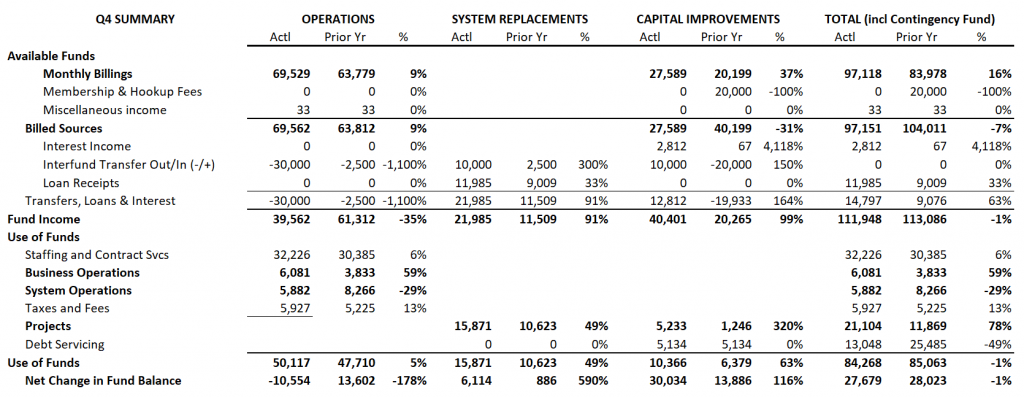

Q4 and our fiscal year 2023/2024 ended on 30 June. Here are 3 summary financial reports with a few comments. You can click on the links at the bottom of the page to get more detailed reports.

- Q4 ended with no surprises:

- — Compared to last year, our monthly billings (first line item) were higher by 16%.

- — The Interfund Transfer line shows that we transferred out $30,000 from the Operations fund. $10k was standard quarterly transfer to System Replacements, $10k was a one-time transfer to Capital Improvements and $10k was a one-time transfer to Contingency/Emergency Fund (not shown on report but included in TOTAL) to pay off our SBA/COVID loan.

- — You’ll see that Business Operations was high due to pre-paying 1 year of subscription for our new billing system and a 2nd recharge of the postage machine (prior year only had one $500 recharge of postage in the quarter.)

- — Systems operations was low as we did not have any large, unexpected maintenance costs.

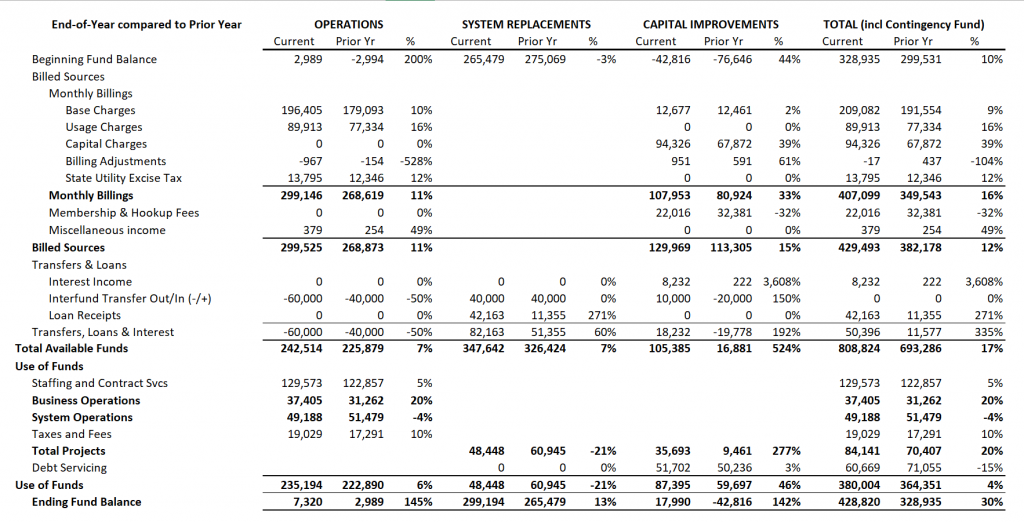

- This summary compares the full year vs last year:

- — The 9% Base Rate change was slightly higher for Operations as we also have a few new Active Accounts (and a couple less Reserve Accounts.)

- — Although Usage Rate was increased 20% the revenue only increased by 16%, indicating a slight reduction in water usage.

- — The 40% increase in Capital Charge (39% in the report) provided an important increase in funds for Capital Improvements.

- — The large increase in “Billing Adjustments” is primarily due to a couple larger than usual claims for credits due to accidental water usage. Buried in this number is that our Good Neighbor credits only cost us $550 thanks to member donations.

- — The big increase in Interest Income (under Capital Improvements) is due to rebuilding our reserves and moving our savings to a high interest savings account at Kitsap Bank.

- — Loan receipts for System Replacements of $42,163 cover the actual costs we’ve had, to date, for pre-construction activity for the relocation of the Sandy Shores Pressure Reduction Valve (PRV). Actual construction will begin in Spring 2025, funded by a loan from the State of WA.

- — Business Operations increase is due to higher insurance costs and pre-paying the annual subscription for our new billing system. (This new system costs us significantly less than the announced price increase of our current billing system.)

- — Slight decrease in System Operations costs. (Bravo Dave!)

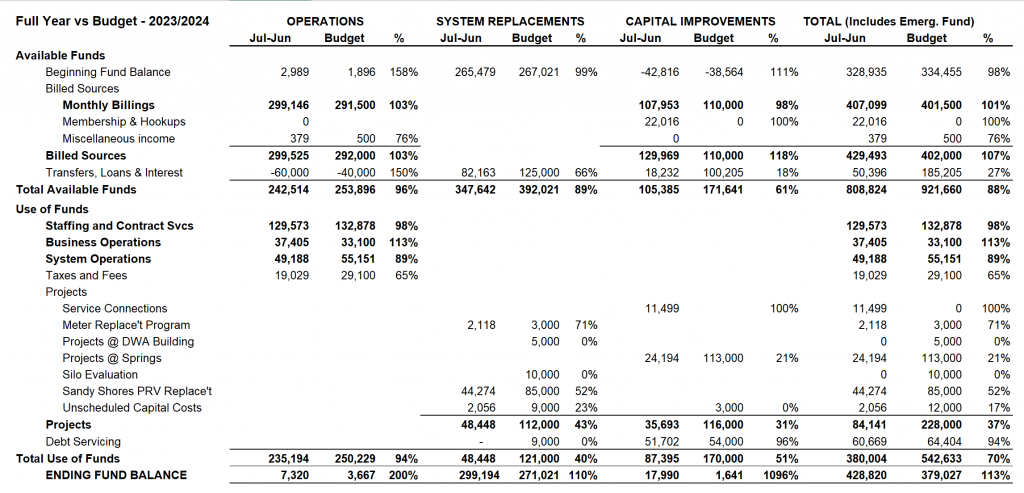

- This final summary compares how we did vs Budget:

- — Monthly Billings were right on target. (That’s Base Charge, Usage Charge, and Capital Charge.)

- — The Transfers/Loans line shows that we borrowed less than planned: we have not completed pre-constructions costs for the Sandy Shores PRV and we chose to down-size and not borrow for the project at Dockton Springs (putting in new deeper wells). Both will continue into the new fiscal year.

- — Business Operations exceeded budget essentially due to Insurance costs and pre-paying annual fee for new billing system.

- — Taxes/Fees are low as, once again, we did not get billed, yet, by King County for our use of rights-of-way (aka Franchise Fee).

- — In Projects you’ll see that we are about 1/2 way through pre-construction at Sandy Shores PRV. Costs at the Springs reflect engineering, construction has not begun. Also, due to timing, we did not get the bill for work on our schoolhouse building prior to reporting. Since the work was completed in June we may get a late invoice, dated June, that we’ll capture in these ’23/24 fiscal year numbers. TBD.

- — We ended the year with funds of $428k versus our budgeted expectation of $379k. Were making progress on our rebuilding our reserves!

Here are reports with more detail line items. For account level report or for any questions, please contact Todd Currie, twcurrie@yahoo.com