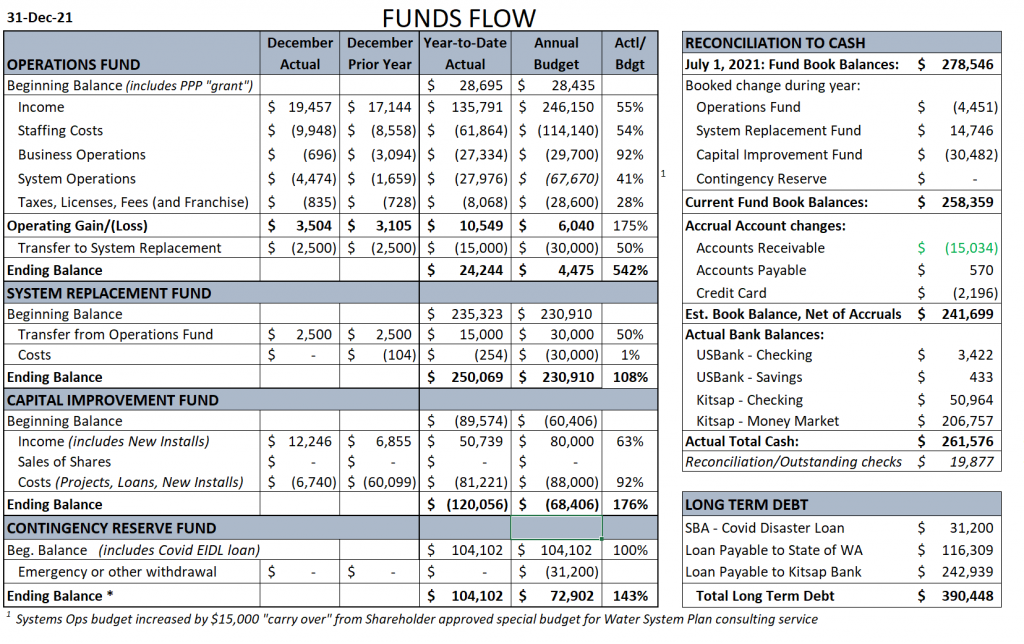

At 6 months, any “straight line” budget items would be at 50%. Operations Income, at 55%, is running ahead. This is due to slightly higher Water Usage as well as the impact of the rate change. Summer billing gets us a fast start on Income every year. Due to the rate change, we will likely continue to generate more income than previous winter and spring months and finish the year with more income than budgeted. This month’s Staffing Costs reflects our new staffing arrangement. We now have one staff member paid by the hour which will slightly increase the variability of this expense.

Business Ops costs were typical in December, whereas last year there were some large insurance and legal fees paid out. On a YTD basis most of our big costs are behind us (Insurance and Legal) but we will finish the year a bit over budget primarily due to the legal fees for the Franchise Fee law suit (which dragged on and is now complete.)

In December, Systems Operations got hit with the big bill to take out the hazard trees at Sandy Shores well. On a YTD basis, Systems Ops costs are OK. The low YTD costs for Taxes is because we have not paid out any King County Franchise Fee/Tax, yet. (Our plan is to use offsets to minimize this franchise fee when it is finally determined.)

No investments/costs in “System Replacements” in December, and essentially none year-to-date — which is helping preserve our reserve funds though we are prepared to spend $30,000 through the year.

High December Income in Capital Improvements is due to billings for new meter installations. Costs for this income is reflected in the Costs line item. We have spent most of our Capital Improvement budget (which includes debt reduction), so the rest of the year our billings for Capital Charges and Base Rates on reserve accounts will reduce this deficit (-$120k) to the amount budgeted (-68k).

A new item included with this report is our outstanding Long-Term Debt. We plan to pay off the Small Business Admin Disaster Loan, this year. The State Loans (there are 2) are serviced one time per year, in the fall, when we reduced the principal by about $28k. The Kitsap Bank loan is paid off about $650 per month. These principal payments are reflected in the Costs line item for Capital Improvements.

Detail Reports from Quickbooks:

Contact me with any questions/comments: Todd, 206-696-1216, twcurrie@yahoo.com